The Estate Administration Process

You just received notice that a loved one passed away, and you were named the executor of the estate. Do you understand how to probate the will, provide notice to beneficiaries, marshal the assets, satisfy creditors and distribute the remaining assets to the appropriate beneficiaries? Do you know how to probate the will, seek a tax waiver, transfer assets, file estate and inheritance tax returns, deal with date of death balances and address other issues?

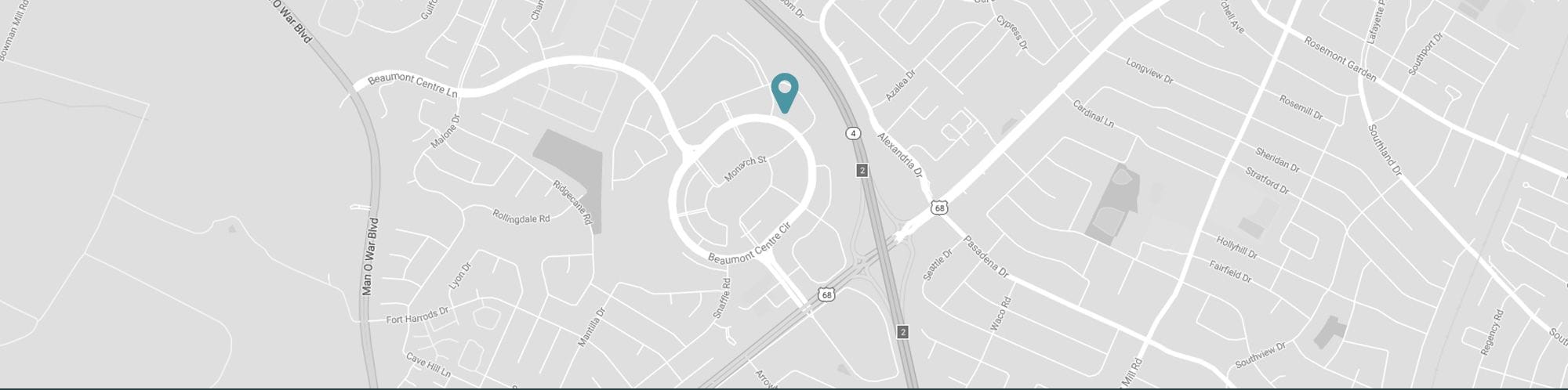

If you don’t, you’re not alone. The New Jersey probate and estate administration process is complex, and nearly everyone needs help navigating it. Here at the law firm of D’Alessandro & D’Alessandro, LLC, our attorneys have been assisting executors, beneficiaries and other individuals in the Basking Ridge, Bernards Township and Bedminster area since 1975. We have the experience and knowledge to help you and your family, too.

Providing The Skilled Legal Assistance That Executors Seek

We support executors of estates through these challenging administrative processes and can even act as executor if we have been appointed by the decedent. An executor’s responsibilities include:

|

|

Administering an estate in New Jersey typically takes one to two years and involves three stages:

- Probate — As executor, you will present the will to the Surrogate’s Court. In exchange, you will receive letters of testamentary (or letters of administration, if there is no will) that grant you the authority to fulfill your duties.

- Assets and debts — You will be responsible for gathering and valuing all the decedent’s assets and paying any outstanding debts. You must also file a tax return or obtain a tax waiver to remove the state’s lien on the assets.

- Close the estate — After payment of all debts and taxes, you will provide a final accounting to the beneficiaries and have them sign release and refunding bonds. Once this is done, you are freed from your responsibilities as executor.

Forestalling Or Resolving Disputes

Our lawyers work proactively to help clients avoid the cost and stress of probate and estate litigation. If estate-related disputes do arise, our skilled litigators are able to resolve them either in court or through mediation. In fact, we are often able to resolve most disputes prior to trial on favorable terms and at substantial saving to our clients.

Call D’Alessandro & D’Alessandro, LLC, at 908-766-5400 or email us today to learn more about how we can be of service. Credit cards are accepted.